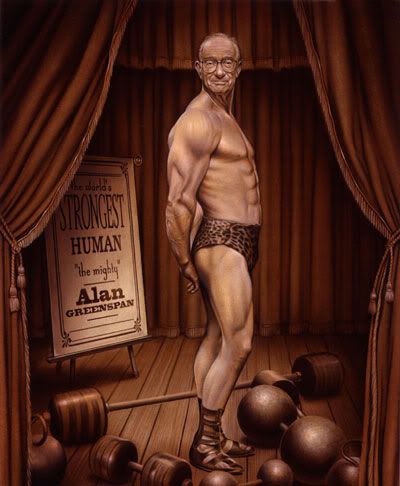

Alan Greenspan is back, looming over the markets, and, even more, over the current chairman of the Federal Reserve! Not that A.G. ever left the scene completely; his comments on an increased likelihood of a recession haunted the markets more than once this year.

But now he´s back for more. His memoirs "The Age of Turbulence: Adventures in a New World", due to hit the bookshelves on September 17, 2007 - which happens to be, incidentally, one day ahead of the Federal Reserve´s next, both eagerly and nervously awaited rate-decision - are bound to haunt the markets, the Bush administration, and his successor as Federal Reserve chairman, Ben Bernanke.

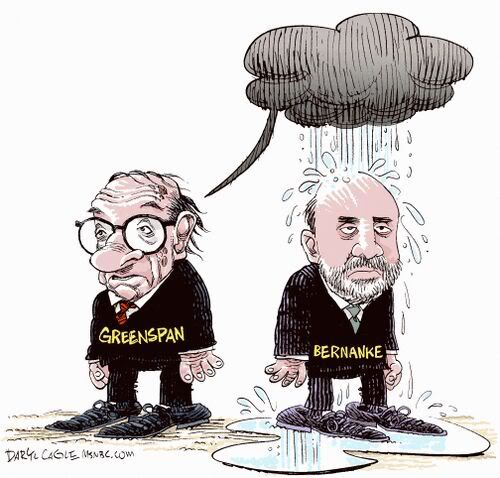

Poor Ben, it should be added, is not in an enviable position right now, stuck as he is between a rock and a hard place: On one side (the rock), the subprime crisis, recent market turmoil and market expectations have put an almost unbearable pressure on him and his Fed to lower interest rates for the first time in more than four years.

On the other hand (the hard place), the Greenback has been on a plunge, not only against the European currency, but against all major currencies, with the notable exception of the Japanese Yen.

Now, while a falling Dollar may be good for exporters, it leads to increased imported inflation, and to a flight of foreign capital from US assets (e.g., stocks: if you, coming from a Euro country, buy shares of an American company, e.g. Microsoft, as the dollar´s value dwindles, so does your Microsoft stocks´, even if the company´s shares remain unchanged).

And now, here is the honorable Mr. Alan Greenspan, former head of the Federal Reserve, with the luxury of no longer having to give a damn, and in a position of pissing against the legs of the government, while at the same time taking an obviously sadistic pleasure to expose to his successor the dilemmas and problems Ben Bernanke and the Fed are facing - dilemmas and problems, that are no longer his to deal with (so-called SEPs - Somebody Else´s Problems).

First, Greenspan paints a dark scenario on what to expect in terms of inflation:

To keep inflation under 2 percent, ``the Fed, given my scenario, would have to constrain monetary expansion so drastically that it could temporarily drive up interest rates into the double-digit range not seen since the days of Paul Volcker,'' Greenspan wrote.

[...]

Consumer prices, which increased at an average annual rate of 3.1 percent during Greenspan's tenure, will likely climb by 4.5 percent or more a year in the future, he wrote.

[...]

Greenspan also forecast an end to the anti-inflation pressures from the inclusion of China and other emerging economies into the global trading system.

[...]

The third source of pressure on inflation will come from U.S. government budget deficits, according to Greenspan. Federal spending absorbs private savings and uses them for less productive purposes, imparting ``a bias toward inflation'' Greenspan wrote.

The federal deficit is something particularly loath to Alan Greenspan: "Deficits don't matter,' to my chagrin, became part of the Republicans' rhetoric,'' he complains about the current administrations budget discipline (or , more precisely, lack thereof).

Next, he outlines what to expect in terms of economic growth, which is no good news, either:

The economy will probably slow to a pace of under 2.5 percent on average from now until 2030, Greenspan forecast in the book.

[...]

Productivity gains averaged a 1.7 percent annual rate in the first six months of this year, down from a 3.6 percent rate during the high-technology boom of 1999. Greenspan forecast a long-term average of 2 percent for increases in output per hour.

He expects increased pressure on the Fed from politics, endangering the agency´s - ahem - independence (the outcome of the September 18 Fed meeting will be a first indicator on how independent the Fed actually is):

"Federal Reserve independence is not set in stone,'' wrote Greenspan, 81, who led the Fed for 18 years until January 2006. ``The dysfunctional state of American politics does not give me great confidence in the short run'' and there may be ``a return of populist, anti-Fed rhetoric,'' he wrote.

(All above quotations are from this Bloomberg article).

Finally, he has the chuzpe to reveal the real motives behind the war against Iraq. No, not the fight against terrorism, or against a rogue regime in the possession of WMDs (the latest rhethorical spin of the government has it that Saddam Hussein had to be removed to prevent him from producing weapons of mass destruction in the future), or to bring freedom, democracy and popcorn to the region.

The war against Iraq was guided by motives related to (surprise, surprise!) oil. Greenspan himself was a proponent of war against Iraq, fearing that control over the Strait of Hormuz - an important passage for oil transports - would enable Saddam Hussein to threaten the USA and its allies.

In essence, Greenspan admits that the whole WMD rhethoric used to justify the war against Iraq was and is nothing but a load of hogwash:

"Whatever their publicized angst over Saddam Hussein's `weapons of mass destruction,' American and British authorities were also concerned about violence in an area that harbors a resource indispensable for the functioning of the world economy."

(Quoted here.)

And as if the turmoil his book is already creating wasn´t enough, Greenspan keeps talking to the press - THE PRESS, for crying out loud! - making sure his irreverent opinions aren´t overheard.

Just in case his earlier recession-warnings will not be forgotten or go unheeded, in his latest interview with the Financial Times, he glumly forecasts that the fall in US house prices triggered by the latest subprime crisis will likely be bigger than expected.

And, heresy of heresies, in another interview (to be published in the September 20 issue of German magazine "Der Stern"), he openly talks about the possibility of the Euro replacing the US Dollar as reserve currency of choice (quoted in the International Herald Tribune).

That will most likely not earn him a long friends list within the administration. But, quite likely, he won´t give a shit.

No comments:

Post a Comment